Announcing Dots’ $8.9M Series A led by DCM Today, we’re excited to share that Dots has raised an $8.9 million Series A led by DCM, with participation from Y Combinator, bringing our total funding to over $14.8 million. Our work building the payout layer for modern platforms was also recently featured in Axios.

Our journey started years ago on Kartikye’s couch - working on a micro-transactions platform for creators, a wild shift from our background of building AI moonshots inside of Google. We pivoted to building Dots because we saw that

Sahil Hasan Feb 25, 26

•

2 min read

Why US Startups Are Moving to Event-Driven Global Mass Payments Is batch processing delaying your global mass payments? Learn why US startups are switching to event-driven payments for instant, milestone-based disbursements.

Simran Handa Feb 24, 26

•

2 min read

What are Global Digital Payments? Are your global payments slowed down by high fees and manual processing? Learn how global digital payments can streamline your international operations and scale your business.

Simran Handa Feb 18, 26

•

2 min read

Best Contractor Onboarding Solutions with Built-In Payments (February 2026 Update) If you're still emailing W-9 forms, copying bank details into spreadsheets, and waiting days for ACH batches to clear, you're losing contractors to companies that pay instantly. The gap between verifying someone's identity and actually sending them money is where most onboarding processes fall apart. Contractor onboarding software with built-in payments closes that gap by running KYC checks and storing payment credentials in the same workflow, so funds are released the moment approval is granted

Kartikye Mittal Feb 16, 26

•

2 min read

Emerging AI Trends in Global Payments Learn how AI is transforming global payments through autonomous commerce and smart routing. Discover how Dots simplifies compliant payouts in 190+ countries.

Simran Handa Feb 13, 26

•

2 min read

What Are the Best Instant Payout APIs for Marketplace Sellers in February 2026? When your sellers cash out on Friday afternoon, they expect funds to arrive before dinner, not the following Wednesday. Legacy payout systems route everything through slow ACH transfers and charge extra fees for anything faster. Marketplace seller payments built on real-time rails like RTP, FedNow, UPI, and PIX deliver funds in seconds with no speed surcharge, which keeps sellers active instead of switching to other platforms. We compared six APIs across payment speed, country coverage, transpar

Kartikye Mittal Feb 7, 26

•

2 min read

Dots vs Stripe: Which is Better in February 2026? You've built your payment acceptance on Stripe, so keeping payouts there seems logical until you calculate the 1% FX markup on every international transfer plus 1.5% for instant access. At 4,000 monthly payouts, those percentages eat more margin than a flat monthly fee with zero FX surcharges. Let's compare Stripe vs Dots on what actually impacts your bottom line: per-transaction costs that compound, geographic limitations that force you to reject talent, settlement speeds that affect contractor

Kartikye Mittal Feb 6, 26

•

2 min read

Dots vs Trolley: Which Payout Solution is Better in February 2026? You're weighing Dots versus Trolley because your current payout process isn't cutting it anymore. Maybe your contractors are asking why they can't get paid instantly, or you're expanding into regions where bank wires don't make sense. The real differences show up in settlement speed, local payment rail support, FX costs, and how fast your team can launch in new markets. We'll compare how each platform handles global coverage, pricing transparency, developer experience, and the infrastructure you

Kartikye Mittal Feb 6, 26

•

2 min read

Dots vs Tipalti: Which Payment Platform is Better in February 2026? You're weighing Tipalti against Dots, and the gap is wider than it looks. Tipalti was designed for mid-market finance teams managing the full accounts payable cycle like invoice approvals, vendor onboarding, procurement workflows, and batch payment runs. Dots is a developer API built to embed payouts into your product and get funds to gig workers, creators, or affiliates in real time. Where Tipalti takes 90 days to implement and routes payments through 50 rails, Dots goes live in under a week an

Kartikye Mittal Feb 2, 26

•

2 min read

Stripe Reviews, Pricing & Alternatives (February 2026) Everyone knows Stripe for taking payments, but when you flip the direction and need to send money out, the platform shows its limits pretty fast. Your first hint comes when you try to pay someone outside the 46 countries Stripe supports, or when you want instant settlement to more than 10 people per day, or when you realize the fees compound across FX conversion and cross-border surcharges. Let's look at what Stripe alternatives actually offer for companies that need to move money globally witho

Kartikye Mittal Jan 30, 26

•

2 min read

Top APIs for Automating 1099 Tax Filing and Contractor Payments in February 2026 If you're building contractor payments into your product, you need two things working together: money movement and tax compliance. Most platforms make you choose one vendor for payouts and another for 1099s, which doubles your integration work and creates gaps where penalties sneak in. The right contractor tax compliance API handles both through one integration. We tested which solutions actually deliver instant payments, automatic W-9 collection, real-time TIN validation, and e-filing without t

Kartikye Mittal Jan 30, 26

•

2 min read

What Are the Best Mass Payout Platforms for Affiliate Networks in February 2026? Your best affiliates won't stick around if they're waiting five days for ACH transfers while competing networks deliver commission payments instantly. Besides speed, you also need coverage for PIX in Brazil, UPI in India, and SEPA across Europe, plus automated KYC collection and 1099 filing that scales to thousands of payees without drowning your ops team. The platforms built for modern affiliate networks handle all of that out of the box, letting you pay anyone in minutes across 300 rails with

Kartikye Mittal Jan 30, 26

•

2 min read

How Playkit Helped 200+ Creators Earn $1M+ in a Year Here's how freelancers working inside today’s flexible work systems stitch together multiple income streams, and tell you where the future of work is heading.

Simran Handa Jan 29, 26

•

2 min read

How Can Deepfakes Affect Payments and Global Onboarding? Are payments and global onboarding vulnerable to deepfakes? Learn why identifying deepfake fraud is a priority and how advanced protocols bridge the trust gap.

Simran Handa Jan 29, 26

•

2 min read

What is Payouts Automation and Why Does Your Business Need It? Moving beyond manual spreadsheets, learn what payouts automation is and why it is essential for scale. Discover how APIs automate payouts and tax compliance.

Simran Handa Jan 28, 26

•

2 min read

Speed vs. Security: What is the Best Verified Payments API for Instant Global Disbursements? Struggling with slow payouts? Discover what is the best verified payments API to balance speed and security for global contractors and gig economy platforms.

Simran Handa Jan 27, 26

•

2 min read

How a Payments API Can Future-Proof Your Financial Stack Automate global payouts and compliance. Learn why adopting an integrated payments API is the crucial long-term strategy to future-proof financial operations.

Simran Handa Jan 23, 26

•

2 min read

How to Integrate a Payout API: A Comprehensive Guide for Growing Platforms Streamline your platform operations by mastering how to integrate a payout API. This guide covers technical workflows, security, and global payment automation.

Simran Handa Jan 22, 26

•

2 min read

Online Bank Transfer API: Building vs. Buying Your Payment Infrastructure Discover why buying an online bank transfer api is a smarter choice than building. Save engineering time and reduce maintenance costs with Dots.

Simran Handa Jan 21, 26

•

2 min read

Why More Organizations are Revolutionizing Contractor Payments with Mass Payouts Solutions Streamline global operations and discover what are mass payouts solutions. Start revolutionizing contractor payments to ensure secure, scalable growth.

Simran Handa Jan 21, 26

•

2 min read

How Does International Fund Transfer Work When Bank Details are Wrong? When a cross-border payment fails, the money doesn’t just instantly bounce back to your account. Here's what to do next.

Simran Handa Jan 17, 26

•

2 min read

What's the Best Way to Pay Contractors? Learn what’s the best way to pay contractors and keep your best talents. Save on resources and keep global payouts safe and secure. Here’s how.

Simran Handa Jan 15, 26

•

2 min read

Why OFAC Screening is Your Startup’s Non-Negotiable Shield Against Global Sanctions Protect your startup from massive OFAC fines. Learn why automated sanctions screening is non-negotiable for secure global contractor payouts API and financial stability.

Simran Handa Jan 13, 26

•

2 min read

How Do Marketplace Payouts Work? How do marketplace payouts work? Discover how a payouts API can simplify seller disbursements and automate tax processing. Read on to know more.

Simran Handa Jan 5, 26

•

2 min read

What are Global Payouts and How Can They Help Your Startup? What is a global payouts API and how can it help scale your business? Eliminate errors and high fees while automating payouts. Read on to know more.

Simran Handa Dec 23, 25

•

2 min read

Why Your Global Strategy Needs Stripe Alternatives Built for Compliance Discover one of the best Stripe alternatives and avoid costly compliance risk. Move from generalized payment processing with dedicated payout infrastructure.

Simran Handa Dec 17, 25

•

2 min read

How Cross Border Payments Work to Avoid Costly Failure Fees Did you know that you can get charged $15 - $20 for failed payouts? Learn how cross border payments work and how you can avoid these repair fees.

Simran Handa Dec 16, 25

•

2 min read

How Real Time Payments Work and Why They are the Future of US Tax Form Disbursements Discover how real time payments work and how they guarantee secure 1099 disbursements. Guarantee year-end tax compliance with an auditable, fast payouts system.

Simran Handa Dec 16, 25

•

2 min read

Why Automated Onboarding is the Critical First Step for Modern Marketplace Payment Solutions Stop manual bottlenecks today. Discover why fast, automated onboarding is essential for all modern marketplace payment solutions. Book a demo today to know more.

Simran Handa Dec 10, 25

•

2 min read

Automate Reconciliations with an API for Payments Still manually processing reconciliations for your global payouts? Discover how to automate this process with an API for payments and start saving resources.

Simran Handa Dec 9, 25

•

2 min read

Beyond P2P: What is an Alternative to PayPal? Discover what is an alternative to PayPal for mass payouts. Start automating compliance, get faster process times and better reconciliation than P2P wallets.

Simran Handa Dec 4, 25

•

2 min read

How Aries Tickets Automates Student Payouts (and Wins Back Hours) with Dots See how Aries Tickets swapped nightly manual payouts for an automated payout API, saving hours, adding payment methods, and delighting student sellers.

Simran Handa Nov 26, 25

•

2 min read

Compliance 101: Which 1099 Form Should You Use for Contractors? Confused which 1099 form to use for contractors? Here’s a quick guide on which form to use and discover how payouts API can help your business stay compliant.

Simran Handa Nov 24, 25

•

2 min read

How Clicki Replaced Manual Venmos with Real-Time Payouts, Powered by Dots How Clicki replaced hundreds of manual Venmos with Dots’ API to automate 2,000+ payouts each month, cut support tickets, and scale growth.

Simran Handa Nov 21, 25

•

2 min read

Modern API Payouts: How Cross Border Payments Work Delayed and unsafe contractor payouts? Learn how cross border payments work and how API payments can make the process fast and secure. Book a FREE demo today.

Simran Handa Nov 20, 25

•

2 min read

From Manual Work to Automation: How CRWD AI Streamlined Participant Payouts with Dots Slow, manual focus-group payments? See how CRWD AI uses Dots to automate participant payouts and scale research operations faster.

Simran Handa Nov 17, 25

•

2 min read

Tipalti vs Dots: The Next Evolution of Global Payments Infrastructure Dots replaces fragmented systems like Tipalti with one global platform for payouts and compliance across 190+ countries and 150+ currencies.

Simran Handa Nov 6, 25

•

2 min read

Paying Freelancers: Is it Better to Pay in Local Currency or USD? When working with contractors, is it better to pay in local currency or USD? Find out which option builds trust and retains global talent.

Simran Handa Nov 5, 25

•

2 min read

AI in the Creator Stack: Where Does Technology Do Its Best Work? At LA Tech Week, Dots hosted “AI in the Creator Stack,” featuring Locker, Beacons AI, Merazine, Stan, Superfiliate, and Hook & Anchor Media, all cutting through hype to reveal where AI truly creates value in the creator economy.

Simran Handa Nov 5, 25

•

2 min read

What are Cross Border Payments and Can You Pay with Crypto? What are cross border payments? Discover the most efficient and advanced way to pay overseas contractors and freelancers. Book a demo today.

Simran Handa Nov 3, 25

•

2 min read

Inside Dots’ SF Tech Week Panel: The Future of Data Labeling and Human Context in AI Dots hosted a panel at SF Tech Week featuring CloudFactory, HumanSignal, Samaya AI, TriFetch, and Waldium, exploring how humans, context, and alignment will define the future of data labeling.

Simran Handa Oct 31, 25

•

2 min read

Why Platforms Are Moving Beyond Stripe Connect: 6 Payout Gaps & What to Do Outgrowing Stripe Connect? Dots unifies payouts, accounts payable, and compliance in 190+ countries, one infrastructure for all your global payments.

Simran Handa Oct 30, 25

•

2 min read

What are the Hidden Financial Drains When Paying International Contractors? Are you paying too much on slow wire transfers? Learn the most compliant, cost-effective, and secure methods in paying international contractors.

Simran Handa Oct 27, 25

•

2 min read

How Real-Time Validation and Anomaly Detection Secure Your Global Payouts Don't let fraud jeopardize your finances. Discover how a secure global payments API can protect your international payouts and speed up payment processing.

Simran Handa Oct 24, 25

•

2 min read

1099s

How to Accurately Verify Contractor Bank and Tax Information With help from Dots, discover how to accurately verify tax and bank information for contractors, preventing potential issues like fraud from occurring.

Simran Handa Sep 23, 25

•

2 min read

Case Studies

CookinGenie’s Secret Ingredient: Fast, Flexible Payouts Powered by Dots Is your gig marketplace struggling with payment delays and 1099 forms? Learn how Dots helped CookinGenie reduce manual time, automate tax filing, and more.

Simran Handa Sep 8, 25

•

2 min read

Case Studies

Why Teams Switch to Dots Are manual payouts and slow speeds impacting your growth? See why top teams switch to the Dots payouts platform to automate payments and simplify 1099s.

Simran Handa Jul 31, 25

•

2 min read

Contractors

What to Know About U.S. Tax Withholding for Foreign Contractors and Non-Residents Navigating U.S. tax withholding for foreign contractors and non-residents? Learn key insights to ensure compliance and optimize financial processes here.

Simran Handa Jul 15, 25

•

2 min read

1099s

What to Know About 1099 Filing Penalties Learn about the crucial aspects of 1099 filing penalties to ensure compliance and avoid financial repercussions. Stay informed with our comprehensive guide.

Simran Handa Jul 14, 25

•

2 min read

FAQ

What is IRS Form W-9? Everything You Need to Know Discover IRS Form W-9: Your essential guide to this tax document, when to use it, and how to fill it out accurately. Get started with Dots today!

Simran Handa Jul 11, 25

•

2 min read

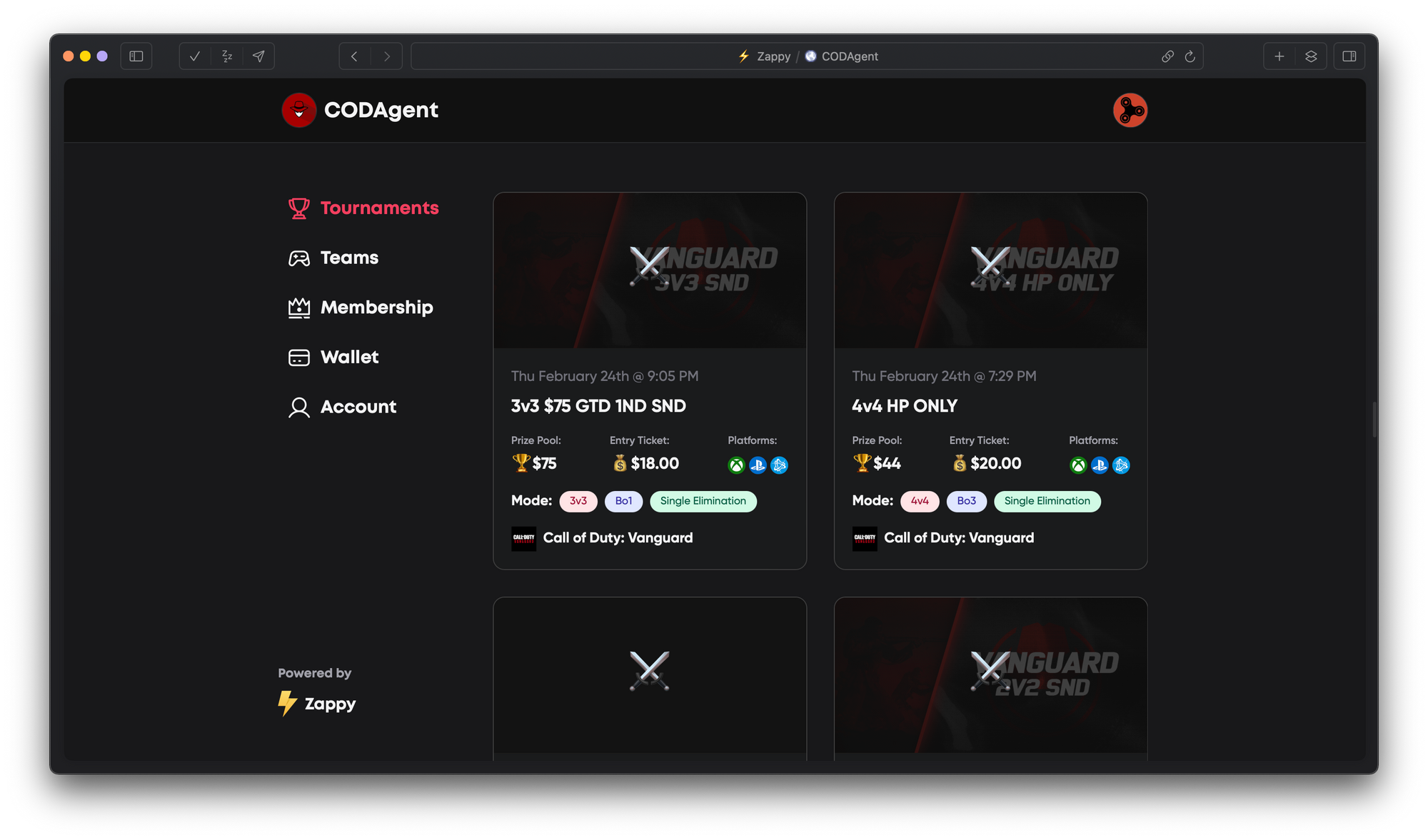

Esports

How Payouts APIs Can Prevent Prize Money Disputes in Esports Explore the role of Payouts APIs in ensuring transparent and dispute-free distribution of prize money in esports tournaments.

Simran Handa Jul 10, 25

•

2 min read

Esports

Streamlining Tournament Operations: The Role of Payouts APIs in Esports Explore how Payouts APIs revolutionize esports tournaments, ensuring seamless prize distribution, efficiency, and an enhanced gaming experience.

Simran Handa Jul 9, 25

•

2 min read

Payouts

How Automated Payouts Can Help Your Small Business Are you a small business owner looking to streamline your operations? Automating your payouts is one way that you can boost efficiency. Learn more here.

Simran Handa Jul 8, 25

•

2 min read

API

How to Integrate Payouts APIs into Your Platform Unlock seamless transactions by learning how to integrate Payouts APIs into your platform. A step-by-step guide for efficient financial operations.

Simran Handa Jul 7, 25

•

2 min read

Royalties

How Do Streaming Services Calculate & Distribute Royalties? Streaming services are exceedingly popular in the music industry. With Dots, learn how to calculate and distribute royalties to effectively pay your artist.

Simran Handa Jul 4, 25

•

2 min read

Global Payments

The Future of Disbursements: Exploring Payouts APIs Dive into the future of financial transactions with insights on Payouts APIs. Learn how APIs revolutionize disbursements for seamless, efficient processes.

Simran Handa Jul 2, 25

•

2 min read

Fraud

Fraud Trends in 2025: Paying Out Your Contractors Learn key 2025 fraud trends in contractor payouts and how tools like Dots help protect your business from scams, theft, and platform manipulation.

Simran Handa Jul 1, 25

•

2 min read

Gig Economy

Can Your Business Benefit From Gig Workers? Discover the advantages of integrating gig workers into your business model and how to leverage them effectively to grow your business.

Simran Handa Jun 30, 25

•

2 min read

Fraud

Top 3 Marketplace Fraud Schemes Discover the top 3 marketplace fraud schemes harming buyers, sellers, & platforms. Learn how to prevent scams and protect your marketplace from fraud.

Simran Handa Jun 27, 25

•

2 min read

Fraud

From Sign-Up to Payout: Where Fraud Can Enter Your System Discover how fraud enters your payout system from onboarding to execution and how Dots helps protect your business with built-in fraud prevention tools.

Simran Handa Jun 24, 25

•

2 min read

The Complete Guide to Fast, Secure Global Payouts for Businesses Need a guide to fast, secure global payouts? Use a payouts API for instant transfers, multi-currency support, and full compliance. Read on to know more.

Kartikye Mittal Jun 20, 25

•

2 min read

Blog

Scale Your Global Payout Operations With Modern Infrastructure How to simplify and scale global payouts? Use a unified payouts infrastructure API for multi-currency support, compliance, and automation. Talk to us today.

Kartikye Mittal Jun 20, 25

•

2 min read

Payouts

Most Common Types of Payout Fraud Stay one step ahead, discover the six most common types of payout fraud & learn how Dots’ secure payout platform can protect your business & users.

Simran Handa Jun 17, 25

•

2 min read

Behind the Scenes of a Fraud Attempt: How Fraud Attempts Work Behind the Scenes of a Fraud Attempt: How Fraud Attempts Work

As technology advances and the world becomes more connected, fraud is an ever-growing concern. Fraudsters are not a new threat. However, these criminals are becoming more sophisticated, using stealthy tactics to defraud consumers and businesses. According to the Association for Financial Professionals (AFP), a staggering 79 percent of companies were victims of payment fraud attacks and attempts in 2024. The Federal Trade Commission (

Simran Handa Jun 10, 25

•

2 min read

What are Interchange Fees and How Do They Work? Learn about the intricacies of interchange fees in the payment card industry. Explore structure, rates, regulations, and more in this comprehensive guide.

Simran Handa Jun 3, 25

•

2 min read

Measuring Success: KPIs for Evaluating Payouts API Performance Explore key performance indicators (KPIs) to assess and enhance the effectiveness of your Payouts API and learn how to optimize performance here.

Simran Handa May 27, 25

•

2 min read

How to Disburse Payments to Your Telehealth Doctors With Dots, navigate compensating health practitioners to ensure smooth and fast payments in the telehealth industry, leading to happy physicians.

Simran Handa May 20, 25

•

2 min read

What to Look for in a Telehealth Payouts API Explore key factors for choosing a Telehealth Payouts API to streamline and enhance payment processes for health care providers.

Simran Handa May 13, 25

•

2 min read

Strategies for Expanding Your Affiliate Marketing Network Ready to scale your affiliate marketing network? Learn why businesses are utilizing payouts API for automation, multi-currency payments, and high-security.

Simran Handa May 6, 25

•

2 min read

How to Mitigate Payment Fraud Skimming, phishing and triangulation are just a few ways fraudsters target people and businesses. With help from Dots learn how to mitigate fraud!

Simran Handa Apr 29, 25

•

2 min read

Everything You Need to Run a Successful Affiliate Program Creating a Successful Affiliate Program

Affiliate marketing is a multibillion-dollar industry poised to experience substantial growth over the next decade. The concept is nothing new; the earliest iteration of affiliate marketing goes back to 1989. However, the rise of the World Wide Web made it a compelling marketing tactic as e-commerce started gaining traction. Today, it's a huge part of modern digital marketing efforts. The latest surveys show that over 80 percent of brands use affiliate pr

Simran Handa Apr 23, 25

•

2 min read

Digital Wallets: What Are They and Why You Should Offer Them Digital Wallets: What Are They and Why You Should Offer Them

Digital wallets first entered the financial scene in the late '90s, but it wasn't until smartphones became a ubiquitous part of everyday life that they truly took off. The latest estimates say that over half of all consumers in the United States will use a digital wallet in 2024. Meanwhile, projections show that global adoption will surpass 5.2 billion users by the end of 2026.

It's not hard to see why digital wallets are so popular.

Simran Handa Apr 16, 25

•

2 min read

Case Studies

How Empower Project Uses Dots to Reduce Payout Fraud How do you stop fraudulent payouts and protect donor funds? Empower Project used Dots Control for payout fraud management and cut fraud by over 50%. Here’s how.

Kartikye Mittal Apr 9, 25

•

2 min read

A Guide to Paying Your Creative Freelancers Navigate the art of compensating creative freelancers with our comprehensive guide. Ensure smooth and fair payments in the creative industry.

Simran Handa Apr 8, 25

•

2 min read

What are Real-Time Payments? Discover the ins and outs of real-time payments and how they revolutionize financial transactions. Stay updated with the latest in instant payments.

Simran Handa Apr 1, 25

•

2 min read

Blog

What is Know Your Business (KYB) and Its Relation to KYC? The Ultimate Guide to Know Your Business (KYB) and How it Relates to Know Your Customer (KYC)

We live in an increasingly globalized world where companies like yours can provide service, receive payments, send payouts, and more to consumers and corporate clients domestically and worldwide. While that's undoubtedly benefited businesses in countless ways, it's also created an ever-rising threat of fraud. One recent survey from the Association for Financial Professionals (AFP) found that a staggeri

Simran Handa Mar 25, 25

•

2 min read

How Payouts APIs Improve the Freelance Creative Experience Discover the transformative impact of Payouts APIs on freelance creatives, streamlining payments and enhancing the overall work experience.

Simran Handa Mar 18, 25

•

2 min read

Blog

Supporting Your Growing Business With a Payouts API Need to simplify and scale payouts to support growth? Discover how integrating a payouts API can automate vendor, employee, and customer payments securely.

Simran Handa Mar 11, 25

•

2 min read

Blog

Boosting Efficiency with Payouts API for Vacation Rentals & Property Owners Elevate your vacation rental business! Explore the benefits of Payouts API - faster, secure transactions for property owners. Streamline success now!

Simran Handa Mar 4, 25

•

2 min read

Payouts

Payouts API vs. Traditional Payment Methods What is the Advantage of Using a Payouts API vs Traditional Payment Methods?

Businesses in every industry handle countless transactions every month. Regardless of your company's size, your accounts payable needs are likely substantial. Mass payouts can be a nightmare, whether you're sending payouts to local influencers, global freelancers, or thousands of marketplace sellers. It's one of those facets of business that many leaders believe is unavoidable, with few options for improvement.

Tradit

Simran Handa Feb 25, 25

•

2 min read

Payouts

How to Avoid Payout Failures Avoiding Payout Failures: A Comprehensive Guide to Optimizing Payouts

If your business is responsible for sending payouts en masse, ensuring every payment goes smoothly is important. Whether you're sending funds to gig workers, marketplace sellers, or contractors in another country, reliable payment systems can help you avoid chaos while keeping recipients happy. No matter what type of business you run, efficient online payments keep things running smoothly.

Using a payouts API is a game-chang

Simran Handa Feb 19, 25

•

2 min read

5 Best Practices for Global Contractor Payment Compliance Learn best practices for ensuring compliance when paying global contractors, from tax laws to payment methods and record-keeping.

Kartikye Mittal Jan 31, 25

•

2 min read

What to Know About Compensation in the Construction Industry How do you attract top workers? Understand construction compensation, including hourly, project-based pay, and efficient global payouts keep you competitive.

Kartikye Mittal Aug 26, 24

•

2 min read

Changelog

Changelog - Aug 26 Need cleaner accounting? Our latest changelog adds Quickbooks classes support and User IP tracking for better fraud protection. Read on to discover more.

Kartikye Mittal Aug 26, 24

•

2 min read

Changelog

Changelog - Aug 9 What's new with the Dots Payouts API? The new changelog includes CSV idempotency keys to avoid double payouts, new app compliance features, and tax table fixes.

Kartikye Mittal Aug 9, 24

•

2 min read

Blog

What to Know About Gig Worker Classification Navigating Gig Worker Classification: A Guide for Businesses

An Overview

Classifying gig workers accurately is essential for businesses. This guide provides insights into the factors influencing gig worker classification, the implications for both businesses and workers, and best practices for ensuring compliance. Check local, state, and federal laws for the most current information.

What Factors Influence How Workers Are Classified?

1. Control and Independence

One of the primary factors

Kartikye Mittal Jun 27, 24

•

2 min read

Class Action

The Role of Payouts APIs in Transforming Class Action Settlements How Payouts APIs are Changing the Class Action Landscape

Class action lawsuits are notoriously challenging. Not only do they often take years to litigate, but they're also more complex due to the number of plaintiffs involved. Lead plaintiffs represent an entire group of affected individuals, called class members.

Larger class action lawsuits can have millions of individuals who submit claims. So when it comes time to distribute settlements, administrators have a seemingly impossible task ahea

Kartikye Mittal Jun 26, 24

•

2 min read

Blog

What to Know About Compensation in the Construction Industry How can you simplify paying your crew? Learn how a payouts API handles construction industry compensation efficiently and securely. Read on to know more.

Kartikye Mittal May 31, 24

•

2 min read

Blog

Best Practices for Integrating Payouts APIs into Mobile Apps How to Integrate Payouts API with Mobile Apps

Managing payouts for potentially thousands of mobile application users can be expensive and time-intensive. Improving operational workflows and establishing a more efficient way of sending mass payments is key to reducing costs and improving the bottom line. However, companies that operate marketplace sites, send funds to international gig workers, run affiliate programs, etc., must also provide a user-friendly gateway for payment recipients.

Mobil

Kartikye Mittal May 13, 24

•

2 min read

Blog

RTP vs FedNow: What's the Difference? The Difference Between RTP and FedNow

The rise of gig work and side hustles has paved the way to brand-new ways people can earn money, but it's also highlighted a glaring shortcoming in how people receive money: Lengthy payment processing times. As more and more people explore nontraditional ways to earn an income, the demand for instant payments continues to climb. Everyone, from independent contractors to marketplace sellers, wants ways to get paid on their time.

Thankfully, the financial la

Kartikye Mittal May 9, 24

•

2 min read

Case Studies

Connecting the Dots: Groovetime Groovetime uses the Dots API to push payments to creators who choreograph for dance challenge campaigns sponsored by record labels and artists.

Sahil Hasan May 8, 24

•

2 min read

Gig Economy

What to Know About the IRS Common Law Employee Test Do you work with independent contractors? Navigate the IRS Common Law Employee Test, understand the key factors, and avoid misclassification penalties.

Kartikye Mittal May 6, 24

•

2 min read

Blog

What is the Difference Between a Contingent Worker and Contractor? Are you working with freelancers and contract employees? Learn their differences and discover how you can pay them efficiently through global payouts.

Kartikye Mittal May 2, 24

•

2 min read

Payouts

Supporting Your Growing Business With a Payouts API How to Support Your Business Payouts API

Supporting your business with a Payouts API can be a transformative step towards efficiency, scalability, and enhanced customer satisfaction. In this comprehensive guide, we will explore the nuances of leveraging a Payouts API and how to select the right payouts API provider.

Get Started with Dots Today

A Brief Overview

A Payouts API, in its essence, is a powerful tool that facilitates the seamless transfer of funds from one entity to another. Whethe

Kartikye Mittal Apr 30, 24

•

2 min read

Payment Processing

What is a Merchant Account? The Ultimate Guide to Merchant Accounts

Navigating the complex world of financial transactions in the business landscape requires a fundamental understanding of merchant accounts. As a business owner, having a reliable and secure means to accept payments is paramount to success. In this comprehensive guide, we'll explore the intricacies of merchant accounts, from their definition and types to providers, functionality, benefits, associated fees, and tips for choosing the right provider for your

Kartikye Mittal Mar 28, 24

•

2 min read

Payment Processing

Strategies for Reducing Credit Card Processing Costs Are you paying too much on credit card fees? Reduce credit card processing costs and reallocate financial resources in growing your business. Here’s how.

Kartikye Mittal Mar 19, 24

•

2 min read

Blog

How to Ensure Your Credit Card Processing is Secure How can you secure credit card processing? Our guide shares how you can leverage tokenization, implement PCI DSS compliance, and more. Read on to know more.

Kartikye Mittal Mar 15, 24

•

2 min read

How to Automate Your Accounting Process Tired of slow, manual accounting tasks? Learn how to automate your accounting process for enhanced efficiency, real-time reporting, and better data accuracy.

Kartikye Mittal Mar 14, 24

•

2 min read

The Risks of Manual Payouts and Why Automation is the Solution Is your business exposed to risks from manual payments? Find out why automated payouts are the best way to secure your finances and boost efficiency.

Kartikye Mittal Mar 7, 24

•

2 min read

Payouts

The Impact of Automated Payouts on Employee Retention and Satisfaction Is your team unhappy with traditional payouts? Learn how automated payouts boost employee retention through speed, flexibility, and financial wellness.

Kartikye Mittal Mar 4, 24

•

2 min read

Navigating the Complex World of Credit Card Processing Regulations Credit Card Processing Rules and Regulations: What to Know

Understanding credit card processing rules and regulations is crucial for businesses that handle payment transactions. Compliance with these standards not only ensures a secure and trustworthy payment environment for customers but also protects businesses from legal repercussions. In this blog post, we'll provide an overview of the key credit card processing rules and regulations, covering essential aspects such as PCI DSS, GDPR, AML, K

Kartikye Mittal Mar 1, 24

•

2 min read

Blog

Understanding Form 1099-K Form 1099-K: A Comprehensive Guide

These days, people are finding unique ways to make money. Thanks to technology, opening up a business from home or making extra money as a side hustle is easier than ever. The gig economy is booming and shows no signs of slowing down. As a result, more people earn an income outside standard nine-to-five jobs. While that benefits individuals and small businesses, it can create confusion when tax season rolls around.

If you're a small business owner or part of

Kartikye Mittal Feb 22, 24

•

2 min read

Blog

Tips for Automating Your Payment Processing Automation continues to change nearly every industry. As technology improves and organizations invest in digital transformation, businesses of all sizes are finding new ways to make standard operations more efficient than before. When most people think of automation, they picture high-tech machines simplifying industrial workflows. However, automation software can be a game-changer for many modern businesses both online and offline.

The best example is a payments automation platform. Your compa

Kartikye Mittal Feb 22, 24

•

2 min read

Blog

The Ultimate Guide to Merchant Accounts Navigating the complex world of financial transactions in the business landscape requires a fundamental understanding of merchant accounts. As a business owner, having a reliable and secure means to accept payments is paramount to success. In this comprehensive guide, we'll explore the intricacies of merchant accounts, from their definition and types to providers, functionality, benefits, associated fees, and tips for choosing the right provider for your business.

Get Started with Dots Today

Kartikye Mittal Dec 20, 23

•

2 min read

Filing Form 1099-MISC: What You Need to Know Businesses have a mountain of paperwork to file when preparing their taxes. While employee tax obligations are relatively straightforward, what if you work with freelancers and independent contractors? Self-employed individuals aren't full-time staff employees, so they're exempt from income tax withholding. Because you're not their official employer, you don't have to pay for Medicare and the Social Security Administration taxes. Contractors take care of that with self-employment taxes.

But jus

Kartikye Mittal Oct 25, 23

•

2 min read

Documents You Need When Hiring an Independent Contractor Independent contractors have a lot to offer businesses, big and small. They can help companies meet long- and short-term goals while giving organizations a cost-effective solution for bringing in new talent. More and more businesses are turning to contractors to fulfill roles they may not need on a full-time employee basis. For example, contractors often work on specific projects or cover seasonal staffing issues.

With independent contractors around the world offering their skills, it's also a

Kartikye Mittal Oct 19, 23

•

2 min read

Payouts

What is the Difference Between Real-Time Payments (RTP) and Automated Clearing House (ACH)? Modern banking is more efficient and versatile than ever before. These days, you have numerous options for sending and receiving money. With a payouts API like Dots, you're no longer limited to just one rail when you need to send payments to contractors, marketplace sellers, affiliates, etc. While traditional debit cards and mobile payment services are widely used, electronic money transfer protocols reign supreme.

Businesses looking to pay contractors often choose to make ACH or RTP payments.

Kartikye Mittal Oct 12, 23

•

2 min read

1099s

Remaining Tax Compliant When Employing 1099 Workers If you’re a business that employs freelancers and independent contractors, it’s essential to stay tax compliant. Improperly classifying employees or failing to file the correct tax documents can lead to hefty fines and penalties. To stay compliant, you need to understand your obligations as an employer and ensure you’re following the relevant state and federal laws for 1099 workers.

In this blog post, we’ll provide you with a guide to staying tax compliant when paying your contractors. If you’r

Kartikye Mittal Oct 11, 23

•

2 min read

Payment Processing

How Your E-commerce Business Can Benefit From Multiple Payment Options If you’re an e-commerce business, it makes sense to make the checkout process as simple and seamless as possible for your customers. This means making the process intuitive, but it also means offering multiple payment gateways. Online businesses can benefit from multiple payment options in numerous ways. Whether you want to improve the customer experience or increase revenue, multiple payment options may be your solution. In this blog post, we’ll be taking a closer look at these benefits and tal

Kartikye Mittal Oct 3, 23

•

2 min read

Payment Processing

An Online Business Owner’s Guide to Different Payment Methods There are more digital payment methods available to consumers than ever. If you’re an online business owner, it benefits you to offer multiple payment methods to your customers. It gives them more flexibility and options with how they pay, creating less friction in the checkout process. Less friction means more conversions and more revenue and for you. While it can sometimes be complex to implement these payment methods into your current payment infrastructure, the positive impact is worth the e

Kartikye Mittal Sep 28, 23

•

2 min read

Fraud

How to Protect Your E-commerce Business From Online Fraud Online fraud is a major challenge for e-commerce businesses. It can cost you money and put your customers’ sensitive data at risk. E-commerce businesses owners need to be proactive to prevent online frauds and take the necessary precautions to protect their customers. In this blog, we’ll be diving into the different types of online fraud and how you can reduce your risk.

Read on to learn more or click below to schedule a demo with the Dots payment API.

Book a Demo with Dots

Common Tactics Sc

Kartikye Mittal Sep 25, 23

•

2 min read

Payment Processing

The Ultimate Guide to E-commerce Payment Processing E-commerce business owners can increase sales and conversions with a streamlined and versatile payment process. If you’re looking to improve your payment processes for your business, this guide can help. In this ultimate guide to e-commerce payment processing, we’ll give you all the information you need to improve your payment infrastructure. We’ll be going over the different types of payment processing, security, international payments, the most popular payment processors and more. By the end o

Kartikye Mittal Sep 19, 23

•

2 min read

1099s

Steps for Onboarding a 1099 Contractor Are you a business that needs to onboard 1099 contractors? This can be a tricky process, but it doesn’t have to be that way. In this blog, we’ll provide you with a step-by-step guide on how to successfully onboard 1099 contractors as efficiently and effectively as possible. Onboarding requires proper compliance, understanding of 1099 contractors and more, but we’ll cover everything you need to know.

Ready to learn more? Read on or schedule a demo with Dots to automate compliance and tax reporti

Kartikye Mittal Sep 14, 23

•

2 min read

Payouts

What is an International Bank Account Number and How Do They Work? If you’ve transferred money internationally, you may have heard of IBANs. IBANs, or International Bank Account Numbers, are used worldwide for international and sometimes domestic transactions. But what exactly are these numbers and how do they work? In this post, we’ll be discussing everything you need to know about IBANs.

Read on to learn more or schedule a demo with Dots to learn how you can improve your international payout process.

Book a Demo with Dots

A Quick Overview

An IBAN (Intern

Kartikye Mittal Sep 12, 23

•

2 min read

Case Studies

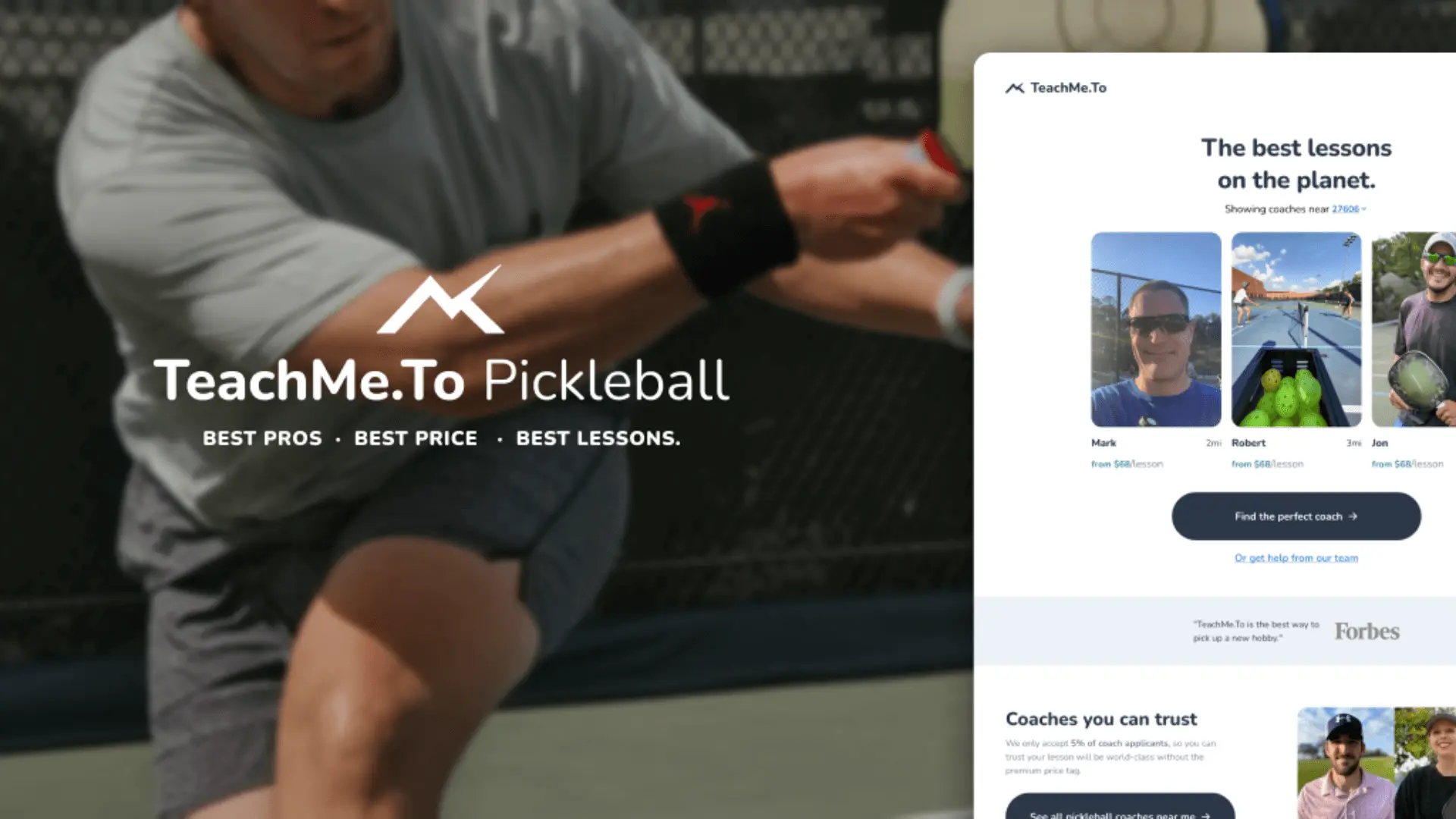

Connecting the Dots: TeachMe.To

With Dots, processing payments is 2 to 3 times quicker than with Stripe. This task used to take half of a day when I was using Stripe, and now it normally takes about an hour each day. It’s a meaningful change for us to reclaim that bandwidth.

Zach Schmid, Head of Operations, TeachMe.To

TeachMe.To is a rapidly growing coaching marketplace that matches students with their perfect coach. TeachMe.To provides their instructors with a business-in-a-box solution, providing access to customer

Kartikye Mittal Sep 5, 23

•

2 min read

Global Payments

The Shift Towards Digital Global Payments The world has drastically shifted toward digital payments over the last decades. As the years have passed, digital payment technology has only become more flexible, secure, and cost-effective. This shift has made it much easier for businesses of all sizes to go global, accepting payments from all around the world and scaling like never before.

Some of the benefits of digital global payments are immediately obvious – they allow companies to reach more customers. Some of the benefits are more sub

Kartikye Mittal Aug 16, 23

•

2 min read

1099s

Everything E-commerce Business Owners Need to Know About Form 1099-MISC If you’re an e-commerce business owner, you need to know about Form 1099-MISC. More importantly, you also need to be aware of the differences between 1099-MISC and 1099-NEC. While you may have used 1099-MISC in the past for certain payouts, you’ll likely need to file 1099-NEC forms instead depending on your business. Taxes can be complicated and dealing with these forms is never an enjoyable process, but it’s important to understand how to file these properly.

We’ve put together an ultimate gui

Kartikye Mittal Aug 8, 23

•

2 min read

Esports

How to Distribute eSports Prize Payments Organizing a video game tournament is already a time-consuming and resource-intensive task. There are anti-cheat measures to consider, roster management, and much more. But perhaps one of the most difficult factors to manage is distributing eSports prize payments. Handling entry fees and payouts for entrants is an essential part of the process, but it can become complex quickly.

It’s a lot of responsibility for an organizer to handle these payouts and it can quickly become overwhelming.There ar

Kartikye Mittal Jul 31, 23

•

2 min read

Contractors

Ways to Pay International Employees and Foreign Contractors With an API Thanks to the internet, it’s easier than ever to broaden your business horizons and operate on a more global scale. The days of being limited to independent contractors and freelancers in your area are over. Collaborators with the specific skills and unique perspectives you want are only a few clicks away. But one obstacle still prevents many companies from tapping into the international workforce: processing payments.

Paying international contractors can get complicated faster than it takes for

Kartikye Mittal Jul 27, 23

•

2 min read

Contractors

How to Easily Pay Your Freelancers and Independent Contractors Business owners need to pay freelancers and independent contractors differently than they pay their employees. Creating a separate process for paying non-employees can be a hassle, especially if you work with a lot of contractors. Fortunately, it doesn’t have to be complicated.

Dots provides a hassle-free and frictionless way to pay out your independent contractors and freelancers, no matter where they are. Wondering what ways there are to pay these non-employees? You have several options, with

Kartikye Mittal Jun 12, 23

•

2 min read

1099s

Compliance for Independent Contractors and 1099 Workers: What to Know Confused about 1099 compliance? Get the full guide on properly classifying contractors, the 3 IRS criteria, and how to file W-9 and 1099-NEC forms.

Kartikye Mittal May 16, 23

•

2 min read

Case Studies

Connecting the Dots: Collabstr

Starting out, our biggest limitation was what we were previously using–Stripe Connect. We kept running into roadblock after roadblock. Initially, it was fine, as we were just using it for basic use cases, but once we needed more flexibility, that's when we were banging our heads against the wall.

Since integrating with Dots, we've been able to increase our signup rates exponentially. More specifically, Dots integration has increased our creator signup conversion rate by 31% for a few reason

Kartikye Mittal Mar 29, 23

•

2 min read

Marketplace

What Marketplaces Need to Know About the INFORM Consumer Act A new law is fighting online fraud. Is your marketplace ready for the INFORM Consumers Act? Read our guide and know how to stay compliant and avoid huge fines.

Kartikye Mittal Mar 23, 23

•

2 min read

Payment Processing

Tips for Streamlining Your Payment Processes Every business can benefit from streamlining its payment infrastructure. However, restructuring your payment processes and workflows can be difficult and time-consuming. But it doesn’t have to be that way. With the Dots API, you can make your payment processes more efficient and save time while also making sure your payout infrastructure is more secure and reliable. Not only can businesses reap huge rewards by streamlining financial transactions, but it can also greatly simplify your customer an

Kartikye Mittal Mar 20, 23

•

2 min read

Case Studies

Connecting the Dots: Forward Forestry Struggling with traditional payouts? Learn how Dots modernized Forward Forestry’s payments with instant ACH payouts, seamless contractor onboarding, and more.

Kartikye Mittal Feb 27, 23

•

2 min read

Compliance

What Is Form W-8BEN? A Brief Overview

Many employers have international workforces, allowing them to get skilled employees from around the globe. Not only does this open up the talent pool, but it can also help you enter new markets and grow your business. W-8BEN Forms are a critical part of hiring foreign employees and contractors. These forms are important to make sure their country of residence is certified and in line with tax regulations.

It’s important for both employers and employees to have their taxes pro

Kartikye Mittal Feb 14, 23

•

2 min read

Payouts

What Are ACH Transactions And How Do They Work? An Overview

Banking is much faster and more efficient in the modern era. Rather than dealing with cash transactions or transactions through checks and cards, you can now transfer money electronically through ACH, also known as the Automated Clearing House

The ACH network has been in operation for decades now, and it’s easily one of the safest and most convenient methods of transferring money. The ACH network can also be used internationally, making it easy to transfer money worldwide, all with

Kartikye Mittal Feb 14, 23

•

2 min read

Payouts

ACH Payments vs Wire Transfers: What’s the Difference? An Overview

Technology has made it much easier for individuals and businesses to exchange funds. Sending money online is more convenient and affordable than ever, with various methods to do so. Some of the most common methods are ACH payments and wire transfers. While the two methods seem similar, they do have multiple differences.

Both methods allow you to send money directly from a bank account, but the method, cost, speed, and availability differ. In today’s guide, we’ll walk you through th

Kartikye Mittal Feb 14, 23

•

2 min read

Marketplace

Monetization Strategies For Your Online Marketplace Implementing a Good Strategy

Online marketplaces are a multibillion-dollar industry, with many businesses getting their piece of the pie. However, to get the biggest share possible you need to have the right monetization strategy in place. The question is, which monetization strategy should you use? The common strategies all have their pros and cons, and there is no “right” answer. The answer will depend on your user base, your industry and what the marketplace is used for.

In this blog, we’ll

Kartikye Mittal Feb 7, 23

•

2 min read

Case Studies

Connecting The Dots: Vantage Sports

The biggest value for us has been organization and time. We've really been able to streamline the service and easily manage our high frequency of low volume transactions. We have a lot of coaches, who are our contractors and used Venmo to pay them out previously, which was free, but inconvenient to keep track of all their handles. And when some people didn't have Venmo, we needed to use CashApp, and when some people didn't have either, I needed to resort to something else. But Dots brought ev

Kartikye Mittal Feb 2, 23

•

2 min read

Payouts

Why Paying Your Contractors On Time is So Important An Overview

Many businesses outsource tasks to freelancers and contractors. This can help organizations get more work done and save money for specialized tasks that don’t require full-time employees. However, just because they don’t work at your company doesn’t mean they shouldn’t be paid in a timely manner.

Some organizations will try to pay contractors in a way that is beneficial for their cash flow and accounts payable, but this often hurts contractors. You have to consider the way contract

Kartikye Mittal Jan 31, 23

•

2 min read

Global Payments

The Best Methods for International Payments An Overview

Accepting payments is essential for any business and with globalization more widespread than ever, accepting international payments is becoming just as important. However, there are numerous different methods for sending and receiving global payments. These methods each come with their own set of pros and cons, and the right method often depends on the situation.

If you’re a business that sends or receives international payments, you need to decide which payment methods to offer. W

Kartikye Mittal Jan 25, 23

•

2 min read

Blog

Dots Payouts API: What is it and How is Your Privacy Protected? Security Is Our Top Priority

The Dots payouts API makes it easy to send and receive payments on numerous payment platforms. Privacy and data security are top priorities for any business. With Dots, you can trust that our API makes sure customer and contractor data is safe, protected and compliant with the highest security and privacy standards.

Learn more about the Dots API and how we protect the privacy of our users.

Get Started with Dots Today

A Brief Overview

First, a brief overview of

Kartikye Mittal Jan 18, 23

•

2 min read

Case Studies

Connecting The Dots: Table22

Before Dots, we used a combination of different services – ACH transfers, a lot of Venmo and Cash App. Cash App was important for us, because we're trying to meet our contractors, delivery drivers, where they are and Cash App is the method of payment that many of them are used to. Transaction fees, in that case, were not insignificant with 3% per transaction at a minimum and it required a lot of time and energy to manually manage payments, largely on phones by relying on one or two different

Kartikye Mittal Jan 5, 23

•

2 min read

Changelog

Dots Update: Enjoy Instant Bank Transfers with RTP Instant Bank Transfers with RTP

Dots now supports and defaults to instant bank transfers over the Real Time Payments rail wherever possible. RTP is supported by most large financial institutions and has coverage over a majority of bank accounts. Instant bank transfers over RTP will be automatic for a payee once we have their SSN, Date of Birth, and address on file.

ID Verification with Persona

After many requests, we've added ID verification through Persona as an optional flow step that yo

Kartikye Mittal Nov 16, 22

•

2 min read

Blog

What Is the Cost of Influencer Marketing? An Overview

A few decades ago, the concept of influencer marketing was nonexistent. The closest thing we had to influencers before the mid-2000s was movie stars and musical artists, and getting their endorsements wasn’t cheap. That all changed when social media blew up. Now, popular content creators are getting the attention of millions of adoring fans worldwide — just by being themselves and producing easy-to-digest content on social media! There’s something inherently down-to-earth about peop

Kartikye Mittal Nov 14, 22

•

2 min read

Changelog

Dots API V2 Updates: User Management, Transfers, and Endpoints Dots API V2

Our API recently turned a year old and in the past 12 months we have received a lot of great feedback from our customers. After a few months of design and development, we are happy to release V2 of the Dots API.

V2 improvements focus on improving the user creation and connection process, introducing transfers, and standardizing our endpoints.

Read the Docs

User Creation Improvements

In V1 of the API, we would return a verification_id when the user was first created. This id c

Kartikye Mittal Oct 18, 22

•

2 min read

Blog

How Long Do Global Wire Transfers Take? Managing Your Payments

Are there people outside of the United States you need to pay? With increasing numbers of companies working with global partners and contractors, international payments are more common than most realize. While there are many ways to perform these transactions, one of the most common methods is to do a wire transfer. Wire transfers let you move money from one bank to the next without taking out cash or writing a check. They’re pretty efficient when done domestically, but w

Kartikye Mittal Oct 13, 22

•

2 min read

Blog

Ways to Pay International Employees and Foreign Contractors With an API Streamline Your Payments

Thanks to the internet, it’s easier than ever to broaden your business horizons and operate on a more global scale. The days of being limited to independent contractors and freelancers in your area are over. Collaborators with the specific skills and unique perspectives you want are only a few clicks away. But one obstacle still prevents many companies from tapping into the international workforce: processing payments.

Paying international contractors can get complicat

Kartikye Mittal Oct 10, 22

•

2 min read

Blog

Connecting the Dots: Don't Tell Comedy

Before Dots, we had to pay a lump sum to every producer and make sure they would would divvy the comedians' payouts on their end. The process was super manual, untrackable and made collecting 1099 information really hard. Dots let us give money to comedians directly. We love Dots so much we're trying to add it to more stuff! They're incredibly responsive and add requested features quickly.

Brett Kushner, Don't Tell Comedy COO

Don't Tell Comedy has built a network of independent comedy

Sahil Hasan Sep 7, 22

•

2 min read

Changelog

Dots Flows: Simplified Onboarding and Payout Setup Flows

Save months of development time by implementing Dots Flows. Flows handle complex tasks like onboarding, collecting tax information and saving payout information. Flows consist of various steps that can be chained together to create your desired flow. For example, onboard users by having them them fill out their SSN, address and date of birth, then have them connect their bank account through Plaid. Once onboarded, payouts can be made through the API or pre-authenticated flows with just t

Kartikye Mittal Aug 22, 22

•

2 min read

Changelog

Dots Update: Custom Logo Support for Payout Links and iFrames Custom Logo Support

Payout Links and Payout iFrames can now be customized with your logo which can be uploaded on the Settings page. More customization options will be added in over the coming weeks.

Fixes and Improvements

* Fixed the dropdown button on all tables

* Added EIN formatting validation to request access flow

* Enabled RTP for certain payouts

* Added tracking for RTP and certain ACH transfers

* Improved sign up flow for existing users

* Added multi-application support

* I

Kartikye Mittal Aug 1, 22

•

2 min read

Changelog

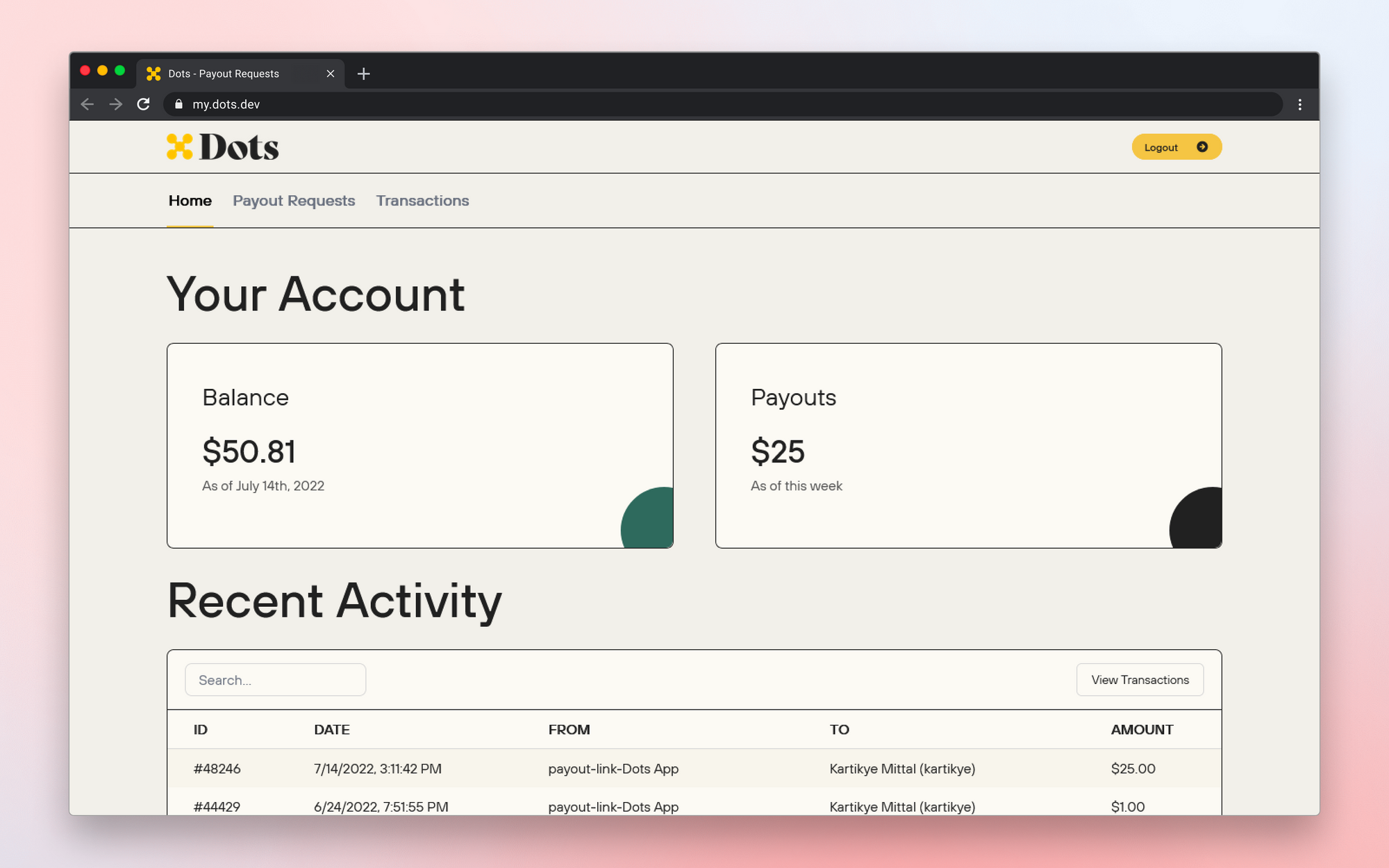

Payout Requests Made Easy with the New Payee Dashboard Payee Dashboard

We're launching a new payee dashboard at my.dots.dev. Currently this new dashboard allows all of Dots' payees to view their transactions histories and create Payout Requests as detailed below. Soon, this dashboard will also allow the management of a payee's connected accounts and other profile settings.

Payout Requests

Payout Requests allow you to send a dedicated link to your contractors, employees and even interns allowing them to submit a request for payment. This can be

Kartikye Mittal Jul 14, 22

•

2 min read

Blog

3 lessons from YC batch that are more applicable than ever 💵Dots was part of the YC S21 batch. We built a developer-friendly API that lets businesses pay their contractors through just a few lines of code. Dots' manages the entire process: information collection (KYC), payments through any rail (ACH, Venmo, CashApp, Zelle, international, and many more to come), and even filing tax forms.

Earlier this week, news broke of a Y Combinator letter sent out to all founders of YC companies. The contents of the letter went on to spark some debate on how much Y

Sahil Hasan May 31, 22

•

2 min read

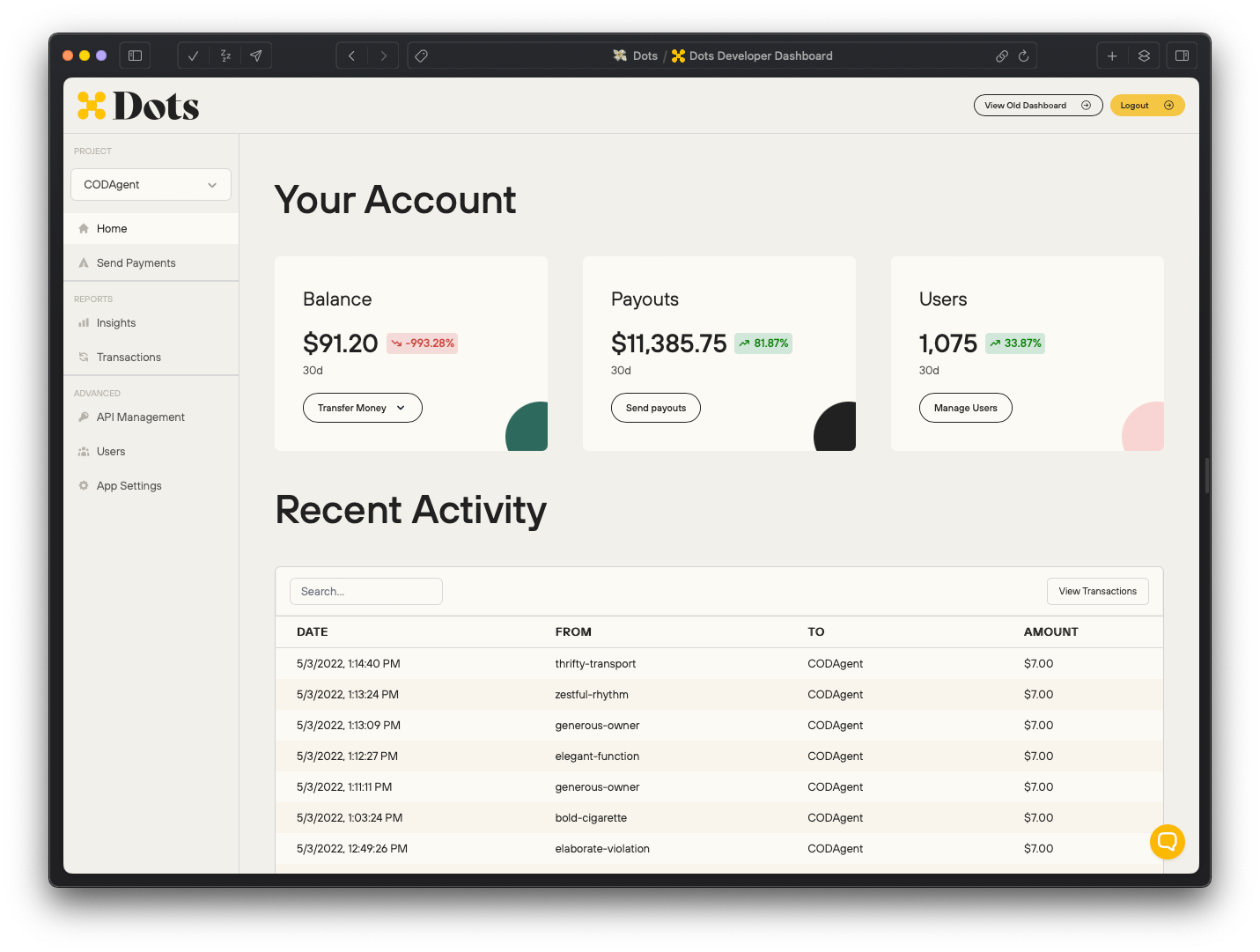

Changelog

Just Launched: Dashboard Dots is excited to announce our new and improved Dashboard! While we push new features into production at Dots near daily, delighting our customers is truly our core KPI. So we've rolled out some highly requested features, all with a more beautiful experience.

📈Dashboard Features:

- Insights into your payouts

- Direct views into User and Transaction Data

- Manual Payout Generator

- API key and App Setting management

- more to come :)

Insights

Our dashboard lets Dots' customers get valuable

Sahil Hasan May 3, 22

•

2 min read

Blog

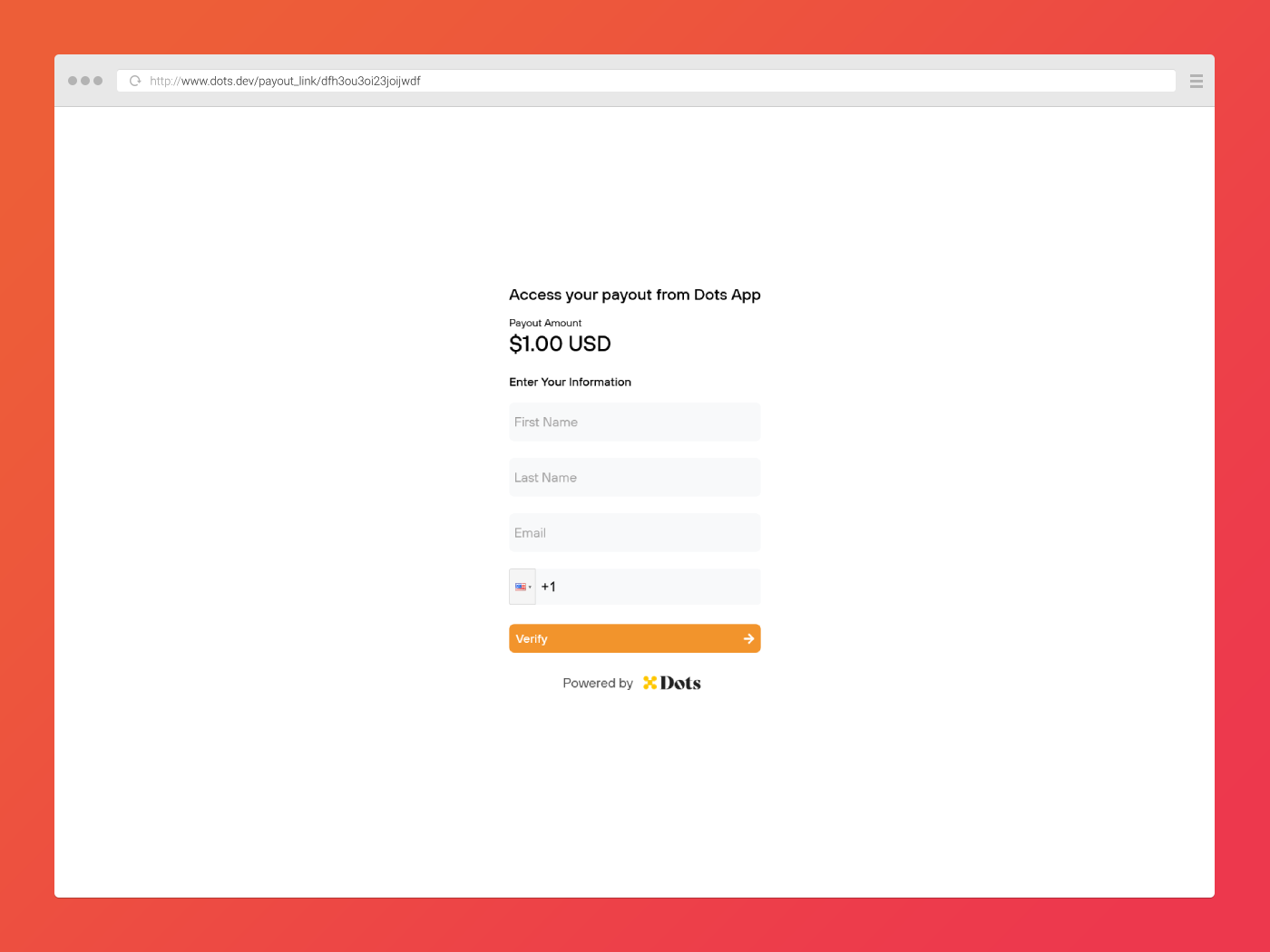

Just Launched: Payout Links The new Payout Links feature allows for payment between two parties with just a few clicks and no code necessary. Simply exchange a link and you can enable payout quickly and seamlessly. This link can be generated through the Dots API or through a dashboard.

Payments can be sent and received using Dots’ integrated ledger and wallet system. Customers can choose to send or withdraw funds in a multitude of ways (payouts to Venmo, Paypal, CashApp, and many more), easily accessible from the Dots App

Kartikye Mittal Apr 4, 22

•

2 min read

Blog

Connecting the Dots: Zappy Implementing Dots even allowed our product to grow over 100% month over month!

Sahil Hasan Mar 4, 22

•

2 min read