Instant Gig Worker Payouts & 1099 Compliance Platform

Pay contractors, couriers, and creators in minutes, via 300+ rails and 150+ currencies, while Dots automates onboarding, TIN verification, and year-end tax filing.

Give operators real-time visibility into onboarding, payouts, and tax filings so teams can scale coverage without adding headcount.

"Switching to Dots cut our driver payout time from days to minutes. Support questions dropped off a cliff, and 1099 season basically runs itself."

Table22 delivers restaurant subscription boxes nationwide. Before Dots, the team paid drivers manually from a bank portal and juggled endless onboarding and bookkeeping tasks, which took 20 hours each week. Today, drivers pick their favorite rail, funds land instantly, and compliance happens behind the scenes. Result: a 45% growth rate in drivers, 20% growth in new restaurants onboarded and hours spent on growth vs manual work.

Daniel Willson

Director of Logistics Ops & Strategy, Table22

Dots: Payouts & Compliance in One Seamless Workflow

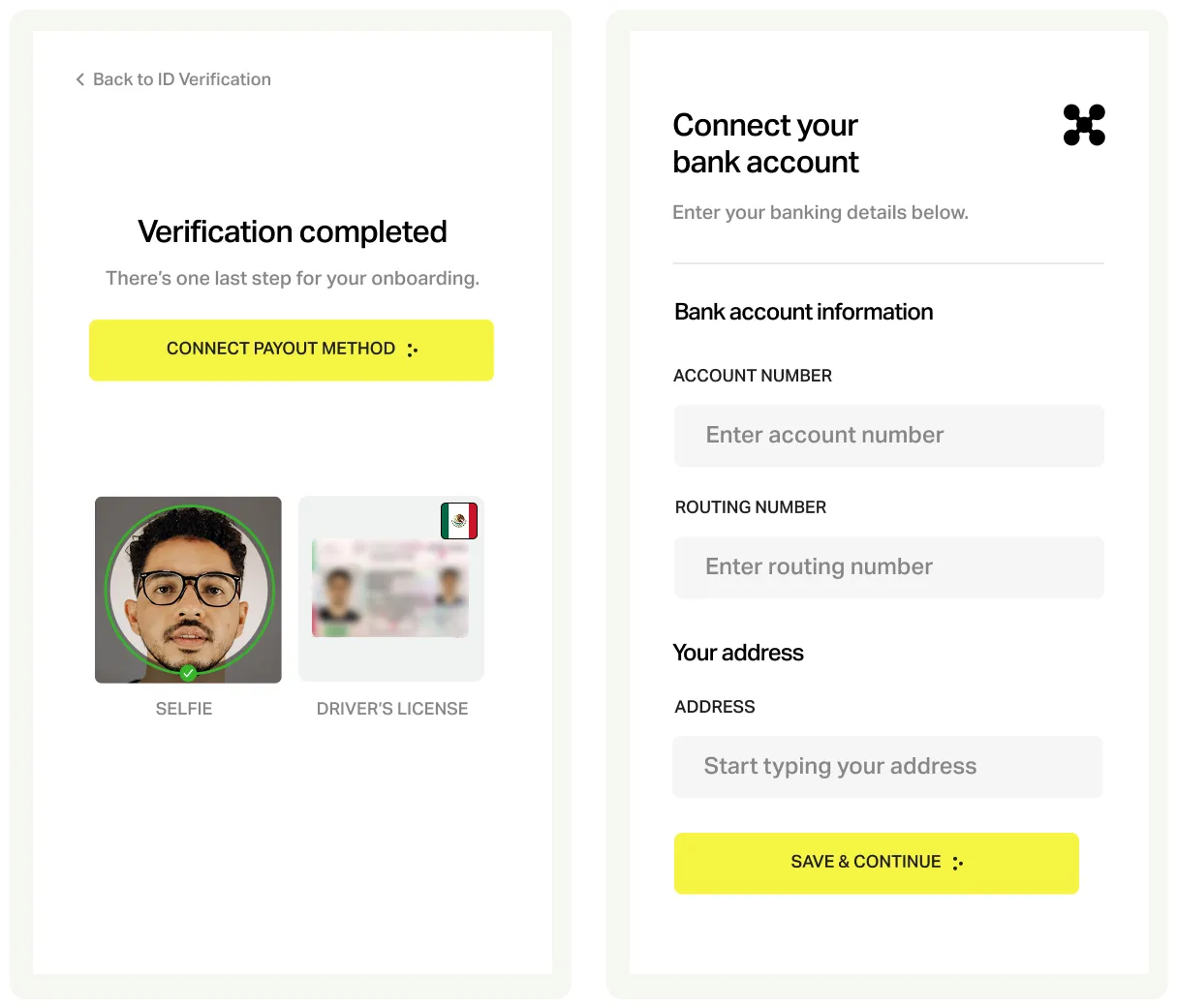

Collect compliance-critical details without slowing activation

- Collect KYC, bank, and tax info in minutes

- Real-time checks against global watchlists and sanctions databases

- Verify TIN instantly with the IRS

Deliver fast payouts across every rail workers prefer

- One API call reaches 150+ currencies and every major rail from UPI, SEPA, ACH, RTP, FedNow, Venmo, PayPal, Cash App, to mobile money, and more

- Live status updates keep workers informed and support tickets down

Keep compliance files tied to every payout automatically

- 1099s generated and e-filed on schedule, tied to every payment record

- Exports plug straight into your accounting stack for instant reconciliation