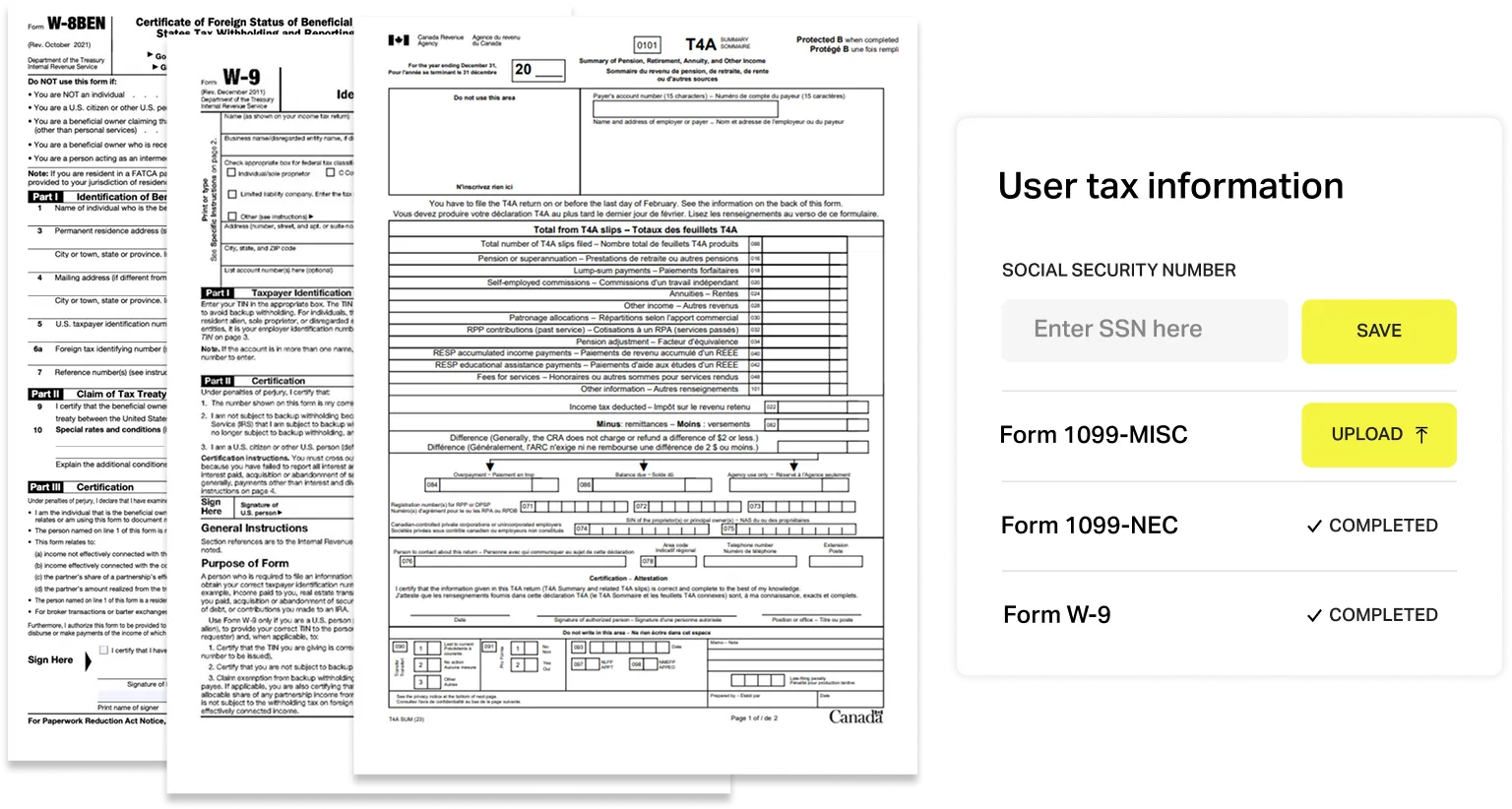

Launch compliant W-9 e-collection flows for both businesses and individuals without chasing paperwork or juggling spreadsheets.

- Guided, white-labeled forms capture every W-9 detail digitally.

- Instant IRS TIN matching spots mismatches before they become penalties.

- Sensitive data stays in our PCI-compliant vault while we e-file federal and state 1099s and handle both mail and e-delivery to recipients.