End-to-end payouts platform that's easy to integrate and customize.

Dots Onboard

Fully white-labeled UI that can screen payees against sanctions lists, verify identity, and collect payout information.

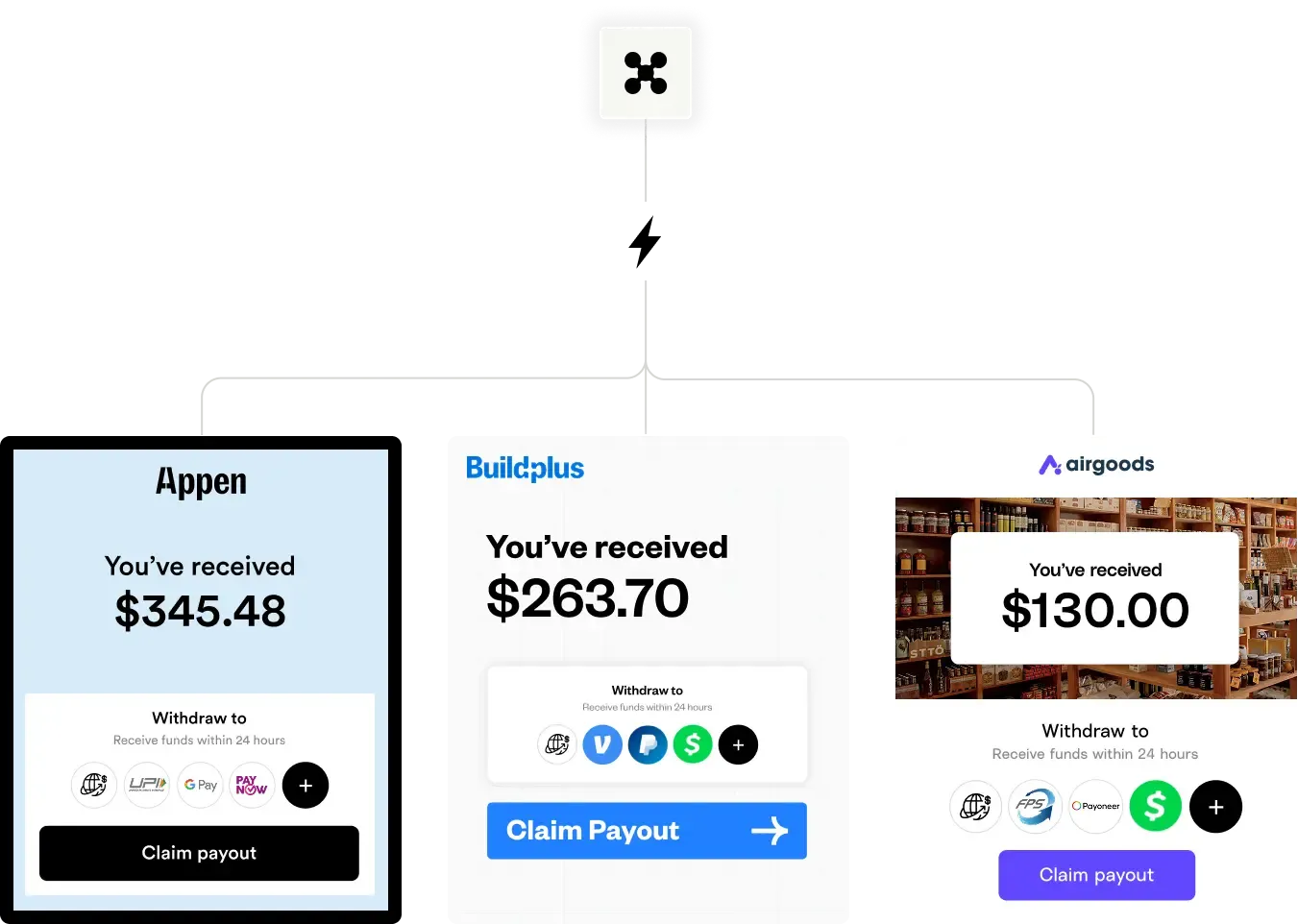

Dots Payouts

Pay through any of our 300+ rails domestically or internationally.

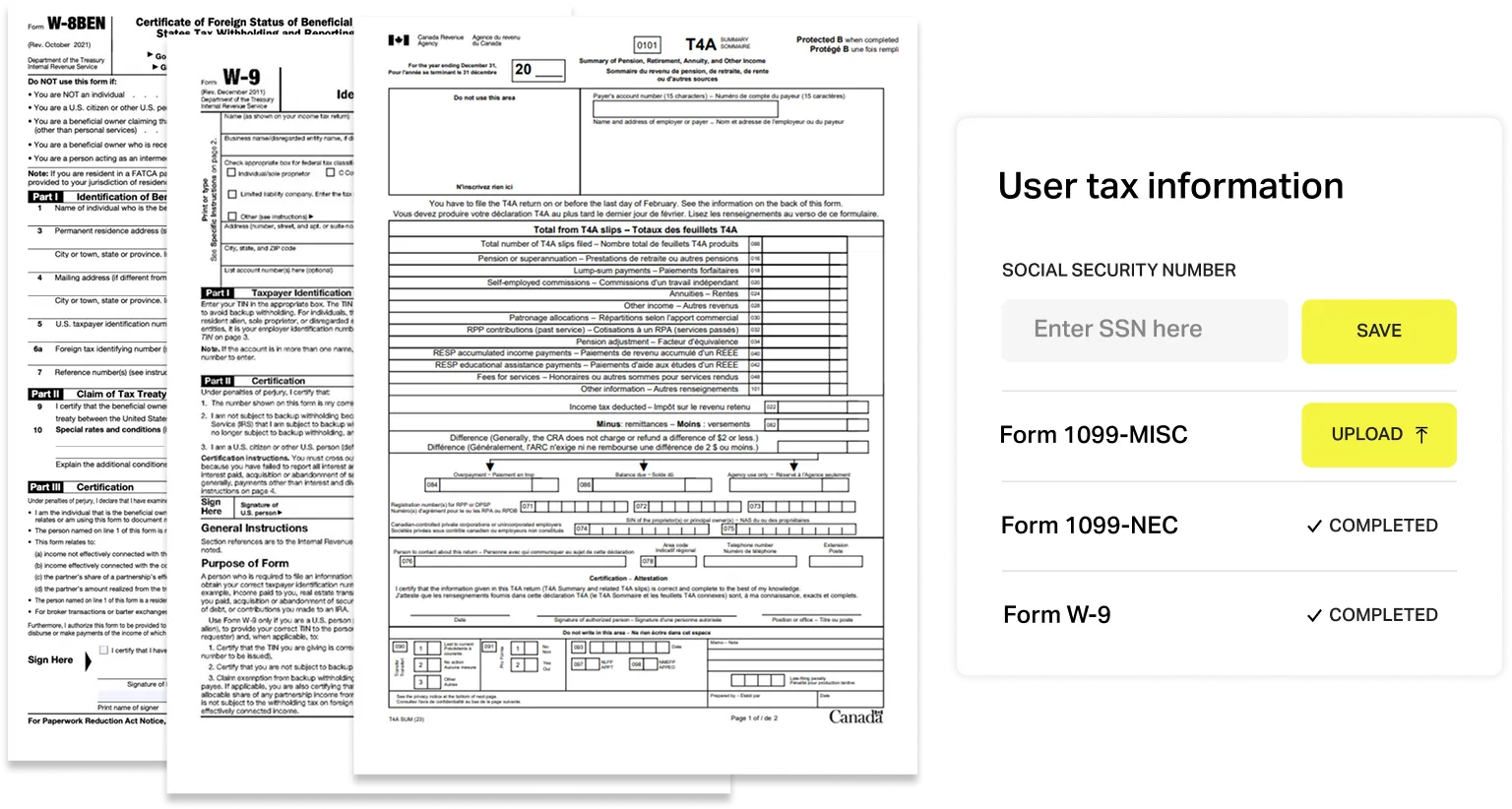

Dots Tax

Detect when tax information needs to be collected, then collect and validate it. File tax forms in the US and Canada.

Dots Payouts

Meet our all-in-one, customizable, API-first platform.

Pay & track payments globally, all in one place.

One place to track all of your payouts, whether you're wiring funds to Tanzania or sending funds via GPay to the Philippines. Let Dots handle currency conversion on the fly seamlessly.

Dots supports over 190+ countries with local payment methods including bank transfers, mobile money, and digital wallets. Our intelligent routing automatically selects the fastest and most cost-effective payment rail for each transaction.

Real-time exchange rates and transparent fees ensure you always know exactly what you're paying. Track every payment with detailed reporting and analytics to understand your global payout operations.

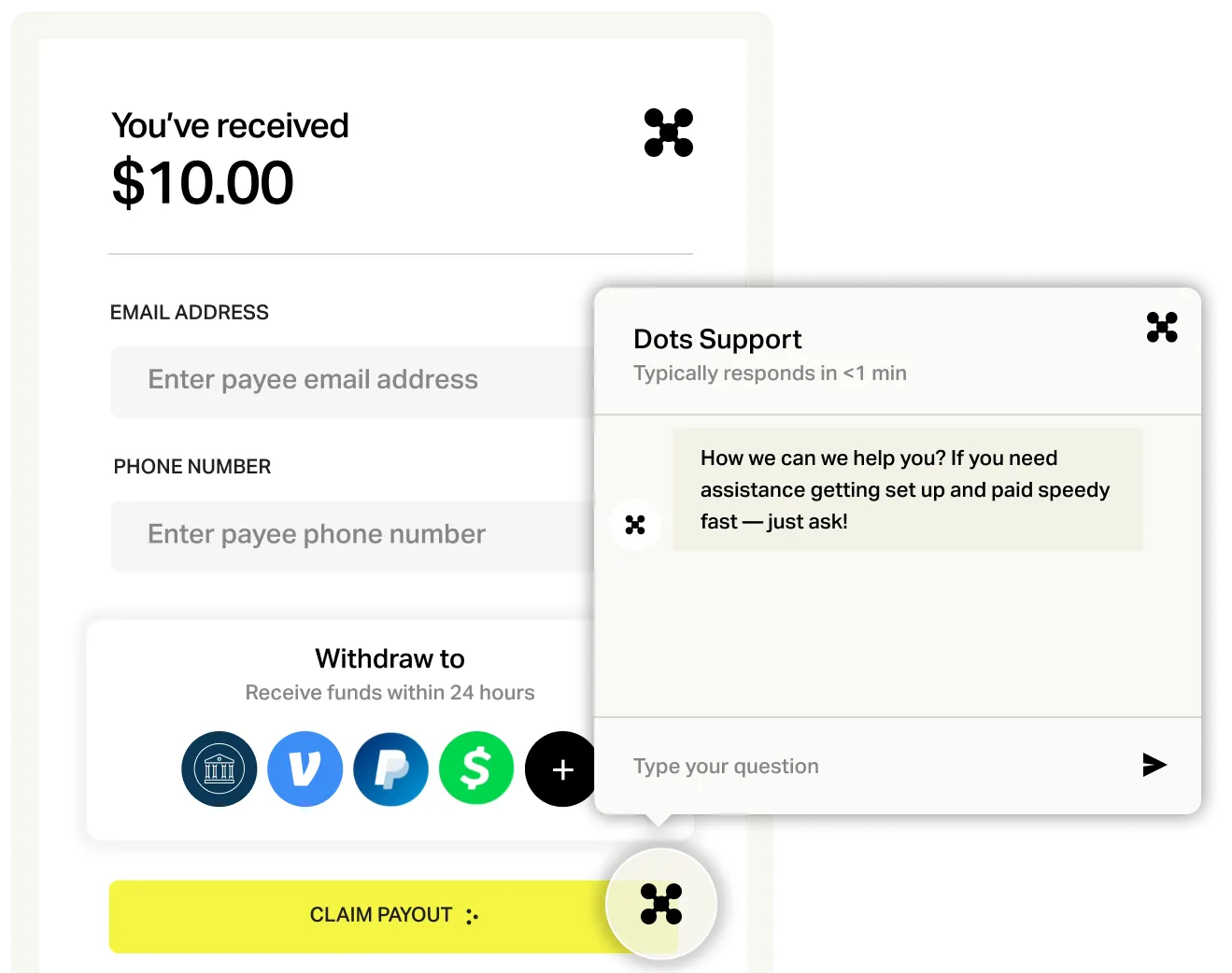

Modern, easy to use UI with built-in customer support.

Dots' UI has been battle tested and optimized to improve payee conversion. Backed by our 24/7 global support we take care of managing payouts, so you don't have to.

Replace hours of manual recipient onboarding with a 5-minute, fully white-labeled flow.

- Identity verification across 190+ countries & territories

- Sanctions & watchlist checks (OFAC) in real time

- Bank details & payout preferences collected and validated instantly where possible

- Flagging of suspicious accounts before payments go out (optional)

- Branded UI means recipients see your platform, not ours

Result: Platforms reduce onboarding drop-off by 20-40% while cutting compliance errors to near zero.

When tax season comes around, you'll be prepared.

Dots will automatically collect and verify the necessary information as payees withdraw funds, balancing user experience with compliance. During tax season, file 1099s with the click of a button.

Stop chasing recipients for forms and dealing with year-end chaos.

- Automatic detection of required tax forms by country + recipient type

- Collection + validation of W-9s, W-8BENs, T4As, and more

- Built-in filing in the US & Canada

- Recipient self-serve portal for uploads, edits, and downloads

- Deduplication of data ensures one profile per recipient — no duplicates

- Result: Dots customers cut tax season support tickets by 70% and reduce filing errors.

Seamlessly embed Dots into your product.

Choose the perfect level of white labeling for your needs.

- No-Code Dashboard

- Get started today with our no-code dashboard to make payouts to your users.

- One-Line Embed

- Add one line of code to your application and let Dots handle your payouts off-platform.

- Drop-in Components

- Embed payouts into your platform through our customizable iFrames.

- White-Labeled Wallets

- Implement a fully native experience & ledger in mere minutes with Dots' unified ledger and API.